Intelligent Underwriter Assistant

UXUI / PRODUCT STRATEGY / RESEARCH / AI

2025

This leading insurance and financial services producer was looking to improve the customer's (corporations & businesses) turn-around time for receiving accurate rates and quotes. This required an improvement in the current underwriter process. The manual pen-and-paper nature of the current underwriter process restricted their ability to scale document extraction, processing, and most importantly, risk assessments. The current tooling that was provided was slower and more cumbersome than using post-its and simple notes docs to track their assessments.

This process was ripe for digitization and AI-powered automation.

My role is the Product Lead in a team of 2 designers, AI product manager, and product owner.

I delivered the current-state research, north star vision, concept design, and concept validation as part of this project. Next steps are included at the end of the case study.

IMPACT

“The underwriters are extremely happy with the direction your team has taken now and they have converted from naysayers to extremely excited for the future of this tool and future iterations!”

VP of Artificial Intelligence Strategy and Development

OPPORTUNITY

Augment the complicated underwriter workflows to simplify workload and expedite completion times by focusing on exception handling rather than mundane processes.

PROCESS

-

Develop the current state understanding by mapping underwriter personas and likely workflow variations based on complexity of client type and volume

-

Uncover underwriter user needs by understanding their current process, wants and pain-points beyond the straight-forward task-completion steps

-

Understand where automation fits into the picture, while addressing fears of automation replacing junior roles

-

Develop north star vision and conduct validation and iterations of design prototype

Research

To understand the current-state:

-

I led direct 1:1 and group stakeholder interviews with the range of personas and mapped the unique industry-specific eco-system, to understand user flow and how it varies by industry and complexity.

-

I conducted a heuristic assessment of the current product with the users, asking them to specify pain-points and desires both at the screen-level and the journey level following this 4 "F" structure.

-

The team also conducted best-in-class competitive research to benchmark our capabilities against other leaders in the same and comparable spaces. We compared both across industry leaders in underwriting and across leading UX experiences for task management, data visualization, and AI-based solutions.

4 F heuristics assessment for current-state platform.

KEY FINDINGS

The previous tool solely relied on replicating the current manual process – which included processing large volumes of documents, ingesting each to eventually determine where the exceptions existed, all culminating in nuanced risk decisions made with years of expertise.

The tool heavily focused on the document upload, ingestion, categorizing, and processing steps – requiring the underwriter to log or highlight categorizations or indicators in a tool that actually slowed them down.

These underwriters were uninterested in this process and preferred their own manual process of notetaking on a post-it over the hand-holding this tool required.

That’s a big pain point.

We discovered these main themes through the tool assessment and interviews:

A.

Underwriters don’t want to manually process and read documents that are “default” and considered “low-risk” or chase down missing documents.

They want to spend more time on making one-off quick risk-based decisions with available critical information.

"Only show me what matters so I can use my expertise efficiently."

B.

Of the 100+ fields that inform a risk decision, underwriters only want to see exceptions or outstanding items on first glance.

However, underwriters are still skeptical of AI-powered analysis and want the option to validate fields that were AI-generated vs. extracted from documents.

"Will AI make my life harder by creating more exceptions?"

C.

The stop-and-start work cadence sucks. Search and request cycles for missing information is a significant time drag.

Underwriters want accurate document processing and proactive request process that know when corrected materials are needed, to streamline the active time working on each case.

"It's frustrating to start on a case only to realize materials are missing."

The key goal was to decrease time spent correcting and resolving information, and increase time validating insights and exceptions to make informed risk-decisions.

This entirely flipped the dynamic.

We were able to redesign the narrative and journey; injecting AI-powered enhancements that didn’t overtake the important decision-making activities but instead did all of the nitty-gritty work that supported fast action on cases. We embedded agentic support to act on behalf of the underwriter to source and request missing or incorrect documentation before they even knew they needed it.

Design Process

The design process included creating a detailed user journey to align all stakeholders plus very low-fidelity wires that allowed me to quickly review with time-sensitive underwriters. We utilized this to validate direction, qualify points of delight vs. points that needed improvement.

High level user journey and low-fidelity screens for concept validation.

The 3 key design solutions we focused on to solve for user needs:

-

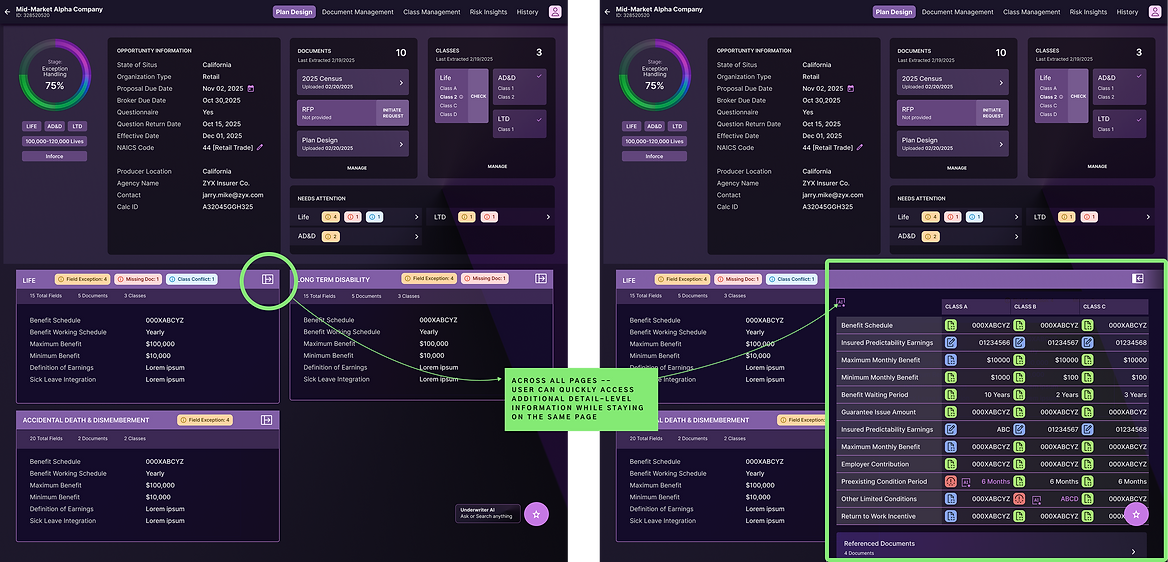

Surface only critical info at point of need: The information that underwriters needed to make a risk decision were the tip of the iceberg, the rest were supplementary information that needed to be accessible but not needed in the foreground. We heavily leveraged the expandable side bar feature at all stages, to allow the user to quickly access additional detail-level information while staying on the same page – this way decisions can be quickly validated and acted upon.

-

Earn trust with transparency: There is a robust matrix of field states based on document availability, historical data, gen-AI analysis, user expertise and adjustments. As tools increasingly make decisions on behalf of the user that may have ripple effects, marking of AI-generated content creates explainability and visibility. The user is also always allowed to revert or adjust those fields with the added benefit of training the model to avoid incorrect inputs in the future.

-

Quick document search and analysis: AI-assisted search leverages intelligent “next likely key-term” to search for fields that the user might not know how to find, based on systems trained on thousands of variations of documents. Every time a correct selection is made, the model is continuously trained to bring accurate findings to the user before search is even needed.

Surface critical information only at point of need.

Build trust in transparency (esp. AI-powered tooling)

Beyond those key capabilities, the product included:

-

“Opportunity Management” views with statuses & immediate tasks

-

AI-prepared “Plan Design” with targeted next steps and outstanding items

-

“Document Management” portal to process and clean documents

-

“Risk Insights” fed from industry and underwriter expertise

-

“History” to track user process over time

INTELLIGENT COMPONENTS (AI/ML)

To ensure designs were not built in a vacuum, I coordinated closely with our Development and AI Strategy teams. Together we designed AI capabilities that were possible for build with our current data infrastructure and training materials. We visioned future-state capabilities that could be add on later down the road when more user data and insights could be leveraged.

-

Document Ingestion & Classification

-

OCR & Document Classification: OCR converting scanned/unstructured documents into machine-readable formats and transformer-based text classifiers to categorize incoming documents by type and relevance.

-

Entity Extraction & Field Mapping: NER (Named Entity Recognition) training on underwriting-specific terminology and historical extractions to pull field attributes from documents with confidence scores

-

-

Intelligent Search

-

Sematic Search: Context-aware retrieval within document repositories

-

Query Expansion & Active Learning Loops: Training based on manually confirming search results and incorporating underwriter user corrections to improve retrieval accuracy over time

-

-

Risk Insights & Exception Assessment

-

Predictive Risk Scoring: Decision tree models utilizing field attributes such as company type, industry type, size, workforce trends, and real-time industry news.

-

Behavioral Pattern Mining: Sequence mining and clustering on historical underwriter actions to extract decision rules

-

Anomaly Detection: Surfacing deviations from standard underwriter patterns and training based on these corrections for unique risk circumstances

-

Design Validation

It was important to validate this product refinement with the key users, especially given they were skeptical with the previous iteration. When users have a product that they find inefficient and makes their workflow harder, the adoption and engagement plummets.

The key goals were to identify usability issues, validate design decisions and workflow, and improve task completion by user testing.

WITH KEY USERS

With our low-fid prototypes, we were able to quickly test our features and interactions without getting bogged down with details. We introduced tasks beyond their current understanding of the required tasks to complete their jobs.

Tasks (oversimplified for example):

-

Complete a case plan for a typical low-risk company (Regional, <1,000 employees) with all expected documents provided

-

Complete a case plan for an exceptional mid/high-risk company (National, >20,000 employees) with outdated documents and missing attributes

FEEDBACK INCLUDED

-

Strongly liked the transparent view of workload and progress with clear indicators of items and tasks that require your attention to resolve

-

Strongly liked the ability to expand/collapse cards to view a deeper level of detail without needing to change pages

-

Strongly liked the ability for AI to identify and preemptively draft outreach to clients for missing documents, and to identify which case are ready for review when all docs are prepared

-

Strongly liked the ability to utilize AI-powered search and field attribute extraction, especially hopeful that with usage and training, time for search will decrease

-

Liked clear indicators of AI-extracted details for transparency

-

Hopeful but uncertain about AI’s ability to identify exceptions or anomalies in field attributes to predict risk assessments

WITH STAKEHOLDER LEADERS

Supportive leaders understand that their key users (in this case their employees) determine the success of a product. Without ego or unrealistic business goals that are not aligned to user needs, leaders can be the biggest advocate for good product work.

“The underwriters are extremely happy with the direction your team has taken now and they have converted from naysayers to extremely excited for the future of this tool and future iterations!”

– VP of Artificial Intelligence Strategy and Development

NEXT STEPS

My role on this project ended as concept design and validation was completed.

-

Continuous design of concept wires and user testing of refined designs towards development

-

User time studies to provide baseline of current state against future state task completion rates

-

Usability testing and AI accuracy improvements